There are a number of one-off cost of living and winter payments on the way this year for people on State Pension.

People on full New State Pension could pay tax by 2028 due to current freeze on personal allowance

19.09.2023 - 13:07 / dailyrecord.co.uk

Some 12.6 million older people could be set for a bumper State Pension pay rise next April under the Triple Lock policy, however, while an increase of 8.5 per cent would undoubtedly help more older people combat the cost of living crisis, it will also push an estimated half a million retirees nearer the personal tax allowance annual limit of £12,570.

An uprating of 8.5 per cent would see those on the full New State Pension receive £11,502 in annual payments from the Department for Work and Pensions (DWP) - 13 payments made every four weeks - leaving them just £1,068 before they reach the personal tax allowance threshold. Some 9.6 million people on the maximum Basic State Pension would receive £8,814 over the 2024/25 financial year under the Triple Lock uprating.

Jason Hollands, Managing Director at wealth management firm Evelyn Partners, warns of a “policy showdown on the horizon between the Triple Lock and Chancellor Jeremy Hunt's multi-year freeze on personal tax allowances”.

He explained: “Both Conservatives and Labour have pledged a commitment to the Triple Lock in their manifestos for the upcoming general election. And the policy of the current Government is to keep the personal allowance frozen until at least April 2028 at £12,570, with no indication of an alternative policy from Labour.

“In the subsequent three years it will require Triple Lock increases of just a sliver greater than 3.0 per cent to take the annual State Pension above the annual personal tax allowance”.

He continued: “That then presents a conundrum to the government of the time: create an administrative and political headache by taxing the State Pension, possibly at source - which would be massively unpopular among the more than 13 million

AHF Opens New State-of-the-Art Capitol Hill Facility

The AIDS Healthcare Foundation (AHF) opened its state-of-the-art facility in the Capitol Hill neighborhood on Wednesday, September 27, with an official ribbon-cutting ceremony. The new AHF Capitol Hill Healthcare Center offers its clients a waiting room-free design, a built-in pharmacy, and holistic care.“The goal is to maximize efficiency using this patient-centered model to improve health outcomes and increase retention in care” said Mike McVikar, AHF’s Regional Director for the DMV.

State Pension 'Shortfall Day' will see most older people spending their full annual payment by this month

There are nearly three months of the year still to go, however, October 5 marks ‘State Pension Shortfall Day’. This is point in 2023 when the average single pensioner would have exhausted their full annual State Pension payment from the Department for Work and Pensions (DWP) - the full New State Pension is worth just over £10,600 this financial year - and be reliant on private pension income or other savings to bridge the gap.

Exact date millions of workers will get £1,000 pay rise as National Living Wage rises in 2024

The exact date for when millions of workers will see a pay rise of around £1,000 in their wages has now been confirmed. Earlier this week Chancellor Jeremy Hunt announced that the government is set to increase the national living wage in the UK to more than £11 an hour.

New update on State Pension annual payment uprating from next April under Triple Lock

The September Consumer Price Index (CPI) inflation rate will be announced on October 18 and forms part of the Triple Lock policy which is used to determine the annual State Pension uprating. Under the Triple Lock, the State Pension increases each year in line with whichever of these three measures are the highest - average annual earnings growth from May to July (currently 8.5%), CPI inflation in the year to September (currently 6.7%) or 2.5 per cent.

New update on calls for State Pension weekly payments of £416 for every person over 60

An online petition calling for the State Pension to be increased to £416 each week for everyone over the age of 60, to match the hourly rate of the National Minimum Wage, has received more than 10,000 signatures of support and is now due an official response from the UK Government.

New and Basic State Pension weekly payment rates for next year could be determined this month

There is a key date this month that everyone claiming their State Pension should be aware of as it could determine how much the contributory benefit will increase next April. The September Consumer Price Index (CPI) inflation rate will be announced on Wednesday, October 18 and forms part of the Triple Lock policy which is used for the annual State Pension uprating.

Chancellor Jeremy Hunt rules out big tax cuts

The Government has said 'no tax cuts are possible in a substantial' way as the Conservative Party conference continues in Manchester today.

Tory MPs to unveil 'manifesto for the north' including calls for dedicated cabinet minister and 500k new homes

There should be a dedicated cabinet minister for the north a group of Tory MPs have claimed. They are also calling for half a million new homes to be built in the region as part of a 'manifesto for the north' which is to be unveiled at party's conference in Manchester.

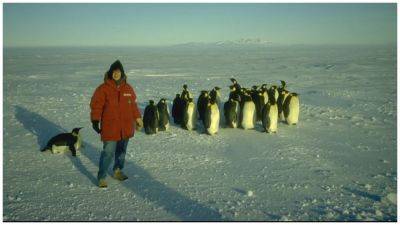

Pioneering Scientist Susan Solomon, Who Helped Save the Ozone Layer, to Be Focus of Film by New State Pictures, Curiosity Film (EXCLUSIVE)

Leo Barraclough International Features Editor New State Pictures has joined forces with Curiosity Rights to secure the life rights of scientist Susan Solomon, who led pioneering research into the destruction of the ozone layer in the 1980s. The partners plan to produce a film that will place a spotlight on how the work undertaken by Solomon and her team led to global awareness of the issue and action to resolve the crisis. Solomon, then only 30, along with her team, unearthed findings that have shaped our approach to environmental preservation.

Alamo Drafthouse Closes New York City Locations ‘Until Further Notice’ Due to Rain Storm, Flooding

Brent Lang Executive Editor Alamo Drafthouse is closing its New York City locations due to a rainstorm that’s left streets and subways flooded across the five boroughs. The theater chain said its venues in Brooklyn, Manhattan and Staten “will be closed until further notice.” On social media, the company said, “Please everyone stay dry & stay safe, and we hope to have you back at the movies very soon.” Rain has blanketed the tri-state region throughout much of the week, but it intensified significantly on Friday, making the city and its surrounding area difficult to navigate and bringing traffic to a standstill.

Manchester Airport calls for HS2 rail in full - and tells government to get 'serious'

Manchester Airport has called for the HS2 rail line to be built in full as promised - from London to Manchester.

Shakira Charged With Failing to Pay Tax on Her 2018 Income

Shakira has been charged.

Thousands of older women could be due State Pension back payments of £5,000

HM Revenue and Customs (HMRC) will start writing to thousands of older people this month who may have been underpaid an average of £5,000 on their State Pension due to missing information on their National Insurance (NI) record. The issue affects mostly women in their 60s and 70s who may have Home Responsibilities Protection (HRP) missing from their NI record.

How surprise inflation drop could impact Bank of England's interest rates decision tomorrow

Economists across the country woke up to surprising new inflation figures this morning.

New State Pension payment warning for people due to reach official DWP retirement age this year

The latest statistics from the Department for Work and Pensions (DWP) show that State Pension currently provides regular financial support for 12.6 million older people across the country, including nearly one million retirees living in Scotland. This payment is available for those who have reached the UK Government’s eligible retirement age, which is currently 66 for both men and women, and have paid at least 10 years' worth of National Insurance Contributions.

People of State Pension age with a savings account urged to check it now

Pension experts are urging older people to check the interest rate they currently have on their savings accounts after new research indicated that at least half of retirees could be missing out on hundreds of pounds each year. Pension Bee warns those missing out most are people with an interest rate of three per cent or less.

New calls for weekly State Pension payments of £416 for every person aged over 60

A new online petition argues that the State Pension is “too low” and should be increased to match the National Minimum Wage. If that sounds like a familiar proposal it’s because another petition, which has received more than 36,700 signatures of support, has made a similar proposal, but was rejected by the Department for Work and Pensions (DWP) last month.

GB News Show Hosted By Politicians Found In Breach By Ofcom Over Impartiality Concerns

Ofcom has found GB News to be in breach of due impartiality rules in a landmark ruling pertaining to an episode of Esther McVey and Phillip Davies’ show.

Nine financial tasks people nearing State Pension age should check now for a smooth move into retirement

State Pension currently provides essential financial support for 12.6 million older people across the country, including more than one million retirees living in Scotland. This regular payment is available for those who have reached the UK Government’s eligible retirement age, which is now 66 for both men and women, and have paid at least 10 years of National Insurance contributions.